Ever since I was a small child I loved making charts and graphs as well as tracking numbers of any kind. I even had a spreadsheet in the bathroom where I required my siblings and I to document if we went number 1 or number 2 and what time said number 1 or number 2 was taken….Yeah, weird I know…

Anyway, since I was old enough to have a bank account I have been fascinated with finances and numbers. I have been tracking my own spending for quite some time and have tried every app out there from EveryDollar, developed by Dave Ramsey (who I’m obsessed with, by the way! I got out of debt using his snowball payoff method a few years ago) to Mint. Now, don’t get me wrong, both these apps are amazing and may even offer exactly what you are looking for, but I have bought countless apps for $1.99 and then immediately deleted them from my phone upon discovering they didn’t have exactly what I wanted. Smart spending, eh?

Well today, I’m happy to share with you a new app I discovered and absolutely love! It’s the Easiest Budgeting App Ever! It’s call My Weekly Budget and you can find it on the app store for just $1.99.

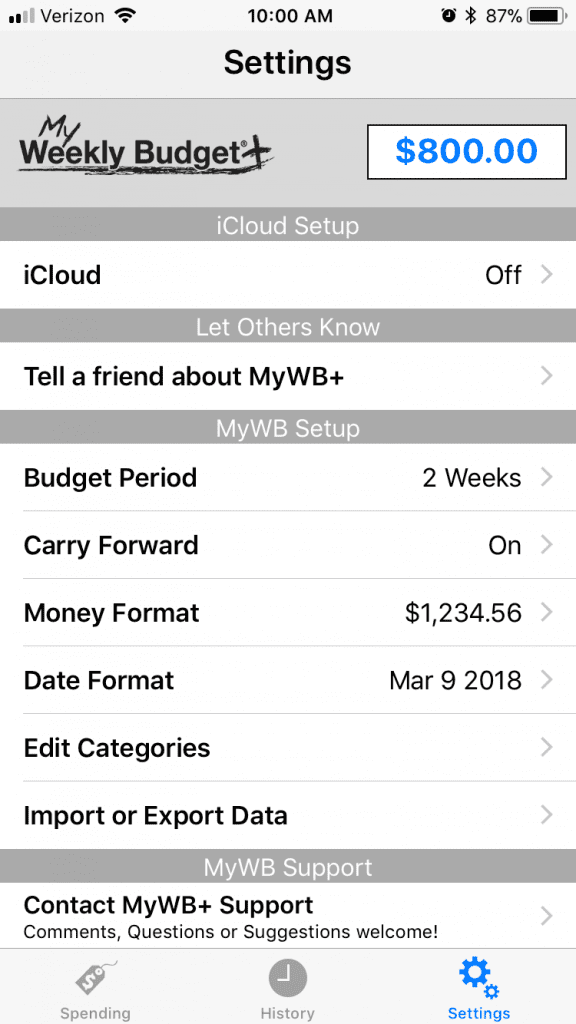

It’s really so easy to use. When you first enter the app you’ll see it’s set to $100 for My Weekly Budget. You can go to the top of the settings page and enter your customized weekly budget.

For example, I have entered $800. You can also edit the budget period. I have mine set to bi-weekly for the purpose of this blog post. You can select 1 month, half month, 2 weeks, or 1 week for your budgeting period and this is what I love most about this app. Some of the other apps I tried were specifically for 1 month budgeting and when you get paid bi-weekly or are an entrepreneur with unstable income each month, it’s incredibly hard to budget for a full month.

Under the history tab if you click on the information at the top of the page it will show you a summary page which is very useful for entrepreneurs, freelance workers, and odd jobs as you can add extra money you’ve made that you didn’t budget into your weekly, bi weekly, or monthly total already.

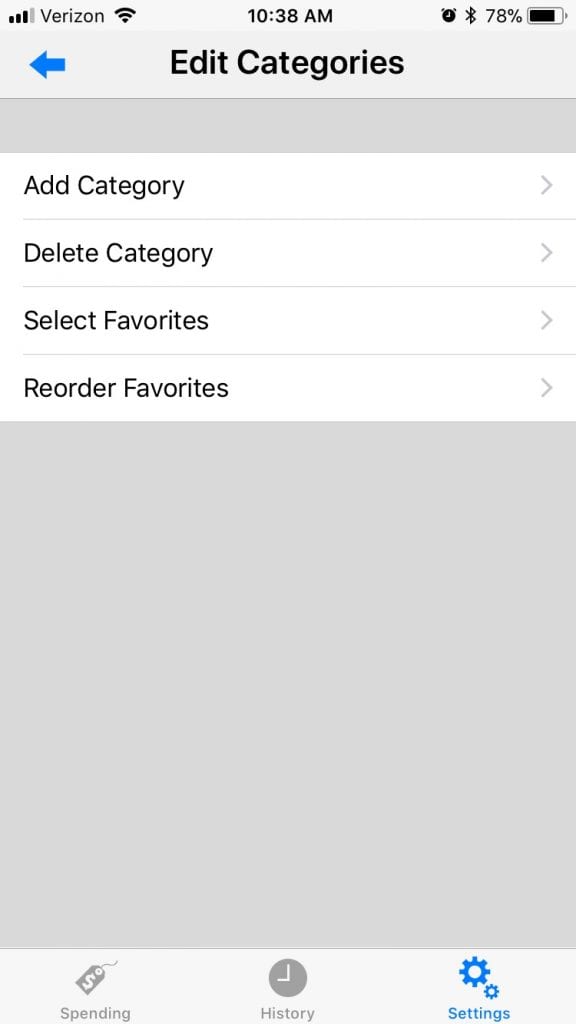

Next, you can add and edit categories.

They have a bunch of categories you can choose from, but I have made my own categories using the Dave Ramsey suggested budget guidelines.

Once you’ve created your categories you can start entering purchases. Now, this is where it will take a bit of discipline. Unlike other apps like Mint, you cannot connect your bank account. For me, this is a benefit! It means I have to think about what I’m about to buy, enter it manually into My Weekly Budget, and decide if I have the money for it or not, right there on the spot. You can’t just swipe your card and have your app deduct and track the information for you. With other apps that track automatically, you can easily go over your budgeting limit and not even realize it until afterward when you receive an email notification or app notification that you’ve gone over!

Every time you purchase something, My Weekly Budget will deduct the amount from your budget and show you how much money you have to spend overall and how many days you have until your next budget period begins. It really puts it into perspective when you see that you have 14 days left until the next budget period and you only have $300 left to spend. This is where extra frugal living comes into play. Even if you have to go over your budget and use your credit card to make it to the next budget period (which I don’t suggest you do), this apps gives you real time updates and when you can see that number directly in front of you, you are less likely to splurge on that expensive top you’ve been wanting. Don’t worry though, you can get it next budget period once you’ve saved for it the proper way!

We, as a society need to get out of the habit of swiping our credit card with the mindset of, “I deserve this.” You absolutely do deserve it, but it’ll feel so much better getting it the right way with your own money and not borrowed money.

Live in the present, not the future, and enjoy each moment the debt free way!

For more information regarding financial trends and investment trends in your Astrology Chart order a reading today!